Question 4: Does GDP stand for Grossly Distorted Priorities?

How the flawed metric created a façade of success, hid the abject economic failure, and opened the door for populism and the extreme right.

That day in May

On May the 14th, 1940 general Schmidt issued an ultimatum to the Dutch forces defending the city of Rotterdam: he would wipe out the city if the Dutch do not cease to resist. In fact, two groups of bombers were already in the air when the ultimatum was issued.

Although the Dutch side responded with readiness to begin the negotiations, Schmidt’s telegram to the air forces ordering them to return to the stand-by status was not relayed on time. The faith of Rotterdam was sealed: 1300 bombs were dropped in the residential areas and the historic centre, killing nine hundred people, and wiping out the medieval city centre.

Today, Rotterdam is a vibrant city with a city centre architecture that is non-characteristically modern for the Netherlands. The few historic buildings and structures that survived the bombing are cherished and defended by Rotterdammers as pieces of their city’s painful history. One such structure that miraculously survived the bombing is Koningshavenbrug, or De Hef lift bridge. Built in 1927 over the river Maas, the bridge has a protected heritage status. The city authorities paid for the renovation of the lift section in 2014, which was finished only in 2017.

You can imagine the surprise of Rotterdammers, when in February 2022 the city authorities announced that the bridge would be dismantled again to allow passage for the newly built superyacht Koru belonging to Jeff Bezos. Koru was built in one of the docks upstream of the city, and its masts were too tall to pass under the lifted bridge.

But people would not have it, as Dr Petra de Jong, behavioural scientist Erasmus School of Social and Behavioural Sciences is quoted saying: "Rotterdammers are extremely proud of the iconic places in the city. Especially the objects that survived the bombing of May 1940. If you touch these, you touch them." An equivalent in Paris would have been a request to temporarily remove the Eifel tower so someone could put up a tent instead.

An equivalent in Paris would have been a request to temporarily remove the Eifel tower so someone could put up a tent instead.

As usual, the mayor’s office put forward the “strong” economic argument: construction of the boat created jobs and brought many economic benefits. After all, Jeff Bezos would foot the full bill of removing and reinstalling the bridge.

The Economic argument

How much economic benefit can one man’s little amusement boat bring to one of the richest nations in the world? The boat in question – Koru, is a luxury 3-masted 127-meter sailing yacht with a price tag of about $500 million and an accompanying 75-metre $75 million (that is a bargain price of $1 million per metre) yacht support vessel. Yes, it is impossible to land one’s helicopter on a sailing yacht, so large sailing yachts have support vessels tagging along with a crew of 30-40 people.

The total sum involved of €600 million is the size of the GDP of a small island state. But for the Netherlands, with its nearly € 1 trillion GDP, this was not a large amount. Still, the politicians and businesses think in terms of GDP growth, not GDP level. The average GDP growth rate in the Netherlands from 1990 to 2024 was only about 0.6%. This means that Bezos’ amusement boat would create a 12% bump in the Dutch GDP growth rate if paid in one year.

If you are a politician and you are given a chance to lift the GDP growth rate by 12%, that is a very convincing economic argument: with one signature you are 12% farther in the global race of GDP growth rates. With a few signatures like that you might even deserve an economic moniker of your own, like “Asian tiger” but for the Netherlands: “tulip tornado” or “polder powerhouse”? Needless to say, as a lowly elected mayor of an egalitarian city, doing a favour to one of the richest people in the world is the cherry on the cake.

On the flip side, the moniker could be more along the lines of “leprechaun economy” as Ireland’s 22% GDP growth was dubbed by Paul Krugman, after Apple moved its intellectual property to Ireland for tax reasons in 2015 and caused such a sizeable increase in GDP, but absolutely zero impact on the welfare of the Irish people.

Eventually, the city of Rotterdam had to refuse the permit to dismantle the bridge after the people threatened to attack the passing yacht with eggs. The yacht had to be assembled in a different dock and made the voyage without the masts.

GDP or Grossly Distorted Priorities?

Hundreds of similar decisions are made by mayors, ministers, and other officials at various levels daily in a country, and the impact on the GDP growth rate and jobs is often the winning argument. But does every increase in GDP growth rate warrant the same consideration?

Does every increase in GDP growth rate warrant the same consideration?

Gross Domestic Product as a measure of economic performance has had plenty of criticism over the years. True that it does not consider work carried out at home or for free, it ignores the shadow economy, it does not consider income distribution or the damage to the environment, but at least we would hope that what it does measure, it does so effectively. Is this the case, though? If GDP is a valid measure, or a key performance indicator, every 1% increase, if legally and fairly obtained, should have comparable positive impact on peoples’ lives.

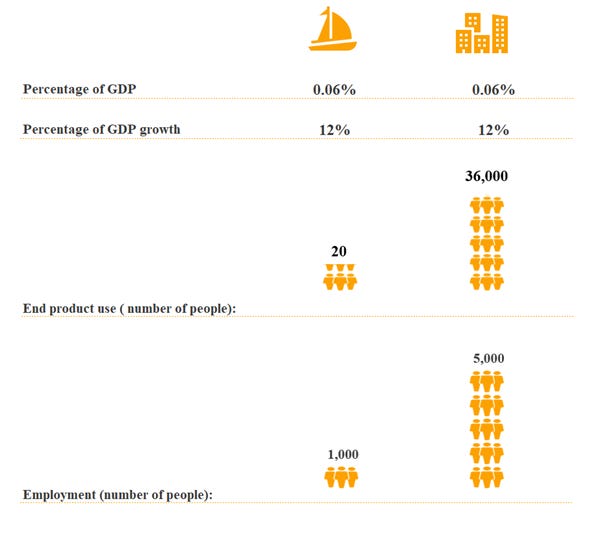

Let us consider the €600 million windfall that Bezos’ joy ride brings to the Dutch economy. This is 0.06% of the economy and 12% addition (note: not percentage point) to the GDP growth rate. We could compare the impact of the yacht with a similarly sized (i.e. €600 million) housing project, for instance. Netherlands, as many of its neighbours, is experiencing a housing crisis as the demand by far exceeds the limited supply.

If GDP is a reasonable or useful measure of economic performance, then the two projects should have comparable impact on the welfare of the Dutch people. The first impact to consider is the result of the project: what is produced of value to the people?

The positive impact of the yacht project benefits Bezos and his immediate family and friends, let us assume that is 20 people. Of course, as the mayor of Rotterdam suggested, the project provides jobs to everyone involved in building and transporting the yacht. For a large project like that, it could be an estimated one thousand people.

The same budget of €600 million in 2021 would yield 12,400 apartment units or help house about 36,000 people. Since building is an inherently less productive industry, the project would provide direct and indirect employment to about 5,000 people. Yet, when it comes to the GDP impact, both projects have the same value.

Imagine that you work in a company where your job description is to help as many people as possible. But when it comes to your performance assessment, the key performance indicator (KPI) your company uses makes no difference whether you helped 36,000 people or 20 people. Wouldn’t you complain to your manager about the Grossly Distorted Priorities?

Trickle-down or hoover-up?

This impact estimate does not consider the self-perpetuating effect of inequality, which is an overlooked problem. The ridiculous trickle-down economics (the notion that creating large profit opportunities for businesses eventually results in benefits to poorer people) is not only faulty, but the total effect is the reverse.

Most industries catering for luxury products have a small proportion of costs spent on labour and a relatively large proportion – on materials, advertising and profit margins. By contrast, most materials used in mass market products are commoditized and cheap, while the margins are low. As a result, a larger proportion of the money spent goes to labour, which then results in direct spending on essential items, creating an income for someone else – a strong multiplier effect.

Luxury spending, on the other hand, creates pockets of accumulated cash in the form of margins and rent, which results in more luxury spending. This crowds out other uses of assets and capital. Unsurprisingly, this creates a fertile ground for developing more luxury offerings in the economy at the expense of mid-market offerings, a form of a hoover-up economics whereby the resources are progressively sucked up the income ladder.

Was it meant to be this way?

Attempts to define a single measure for economic performance had been made long before the twentieth century, but the source of GDP as we currently use in the National Accounts is traced back to the original work carried out by Simon Kuznets, particularly in the congressional report titled “National Income, 1929-1932”. Unfortunately, as it often happens, the concept of National Income and later – GDP, were embraced by governments without much reservation despite the warnings of the very people who produced the original work:

“… in a nation with a rich upper class, the personal services to the rich are likely to be valued at a much higher level than the very same services in another nation, characterized by a more equitable personal distribution of income. A student of social affairs who conceives of a nation's end-product as undistorted by the existing distribution of income, should again have to qualify and change our estimates, possibly in a marked fashion…Economic welfare cannot be adequately measured unless the personal distribution of income is known…The welfare of a nation can, therefore, scarcely be inferred from a measurement of national income as defined above.” National Income, 1929-32, Page 7

Kuznets expressly warns against welfare-related policy decisions based on the measure that he helped develop, yet most of the policy discussions in the corridors of power are intentionally focusing on the GDP number.

Why does it matter?

Policy initiatives discussed at various levels in the governments are often presented in the context of their impact on the GDP growth rates. Even the staunch critics of policies that result in tax and corresponding welfare spending cuts are caught in a false arithmetic tug of war: x% loss in spending/consumption due to the cuts compensated by y% increase in GDP growth rate. But as it was just demonstrated, 1% GDP growth rate can benefit either 500,000 people or 50 people.

In the US, the Joint Committee on Taxation and the Congressional Budget Office are responsible for tallying up the costs and benefits of proposed legislations. The decisions are driven by the high-level impact on the budget deficit, debt, and GDP growth rates, but there is virtually no emphasis on the costs for whom and benefits accrued to whom.

By far the most damaging effect of this myopic focus on the wrong indicator is the wholehearted belief of the legacy political parties and media in the US and Europe that the Western economies are well managed and healthy, with decent GDP growth and employment numbers.

Since the GDP and employment numbers are reasonably high, the US economy is doing MUCH better than people think.

The message from left-leaning media throughout the 2024 campaign was both arrogant and ignorant: “It’s all in your head, in reality, you are doing MUCH better.”

But as it was demonstrated, GDP or even employment numbers do not mean peoples’ lives are better (or worse). In fact, they may not mean anything useful at all! What was the post-Covid life like for the average and poorer 25 percentile of the wage earners in the US given the unequivocally roaring economy according to the Grossly Distorted Priorities?

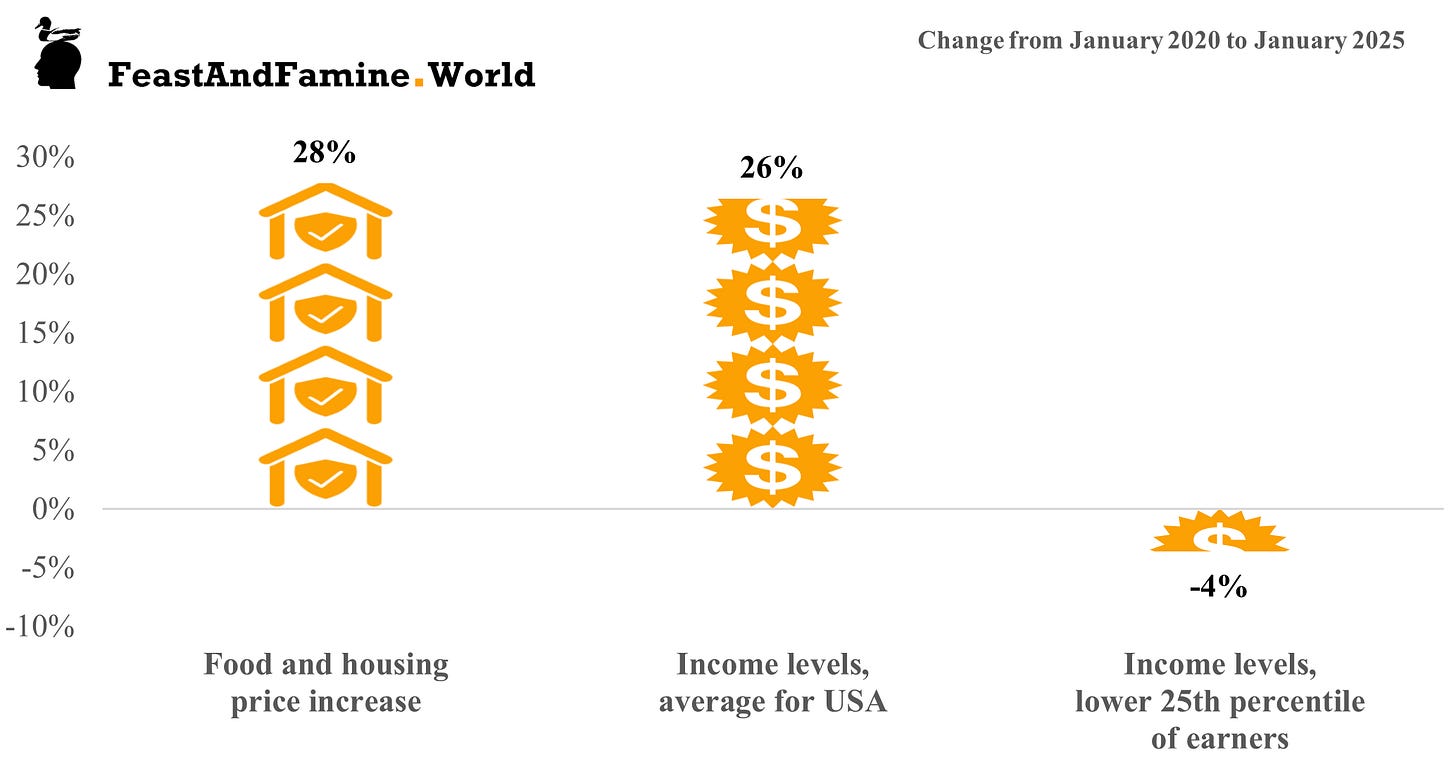

On the average, food and housing prices have increased by 28% since January 2020. Average hourly earnings have successfully kept up with this increase, up over 26%. But when it comes to the lower 25th percentile of the income earners, their income has been down since 2020, rendering them 32% poorer and unable to afford food and shelter.

What about the strong employment numbers? Well, if one must have two jobs to pay for 32% higher food and housing prices, then that is what one does! Shall we all celebrate the miraculous job numbers created by the Biden administration? Congratulations, you are now lucky enough to work 30% more hours to afford the same roof over your head as before!

Congratulations, you are now lucky enough to work 30% more hours to afford the same roof over your head and food as before!

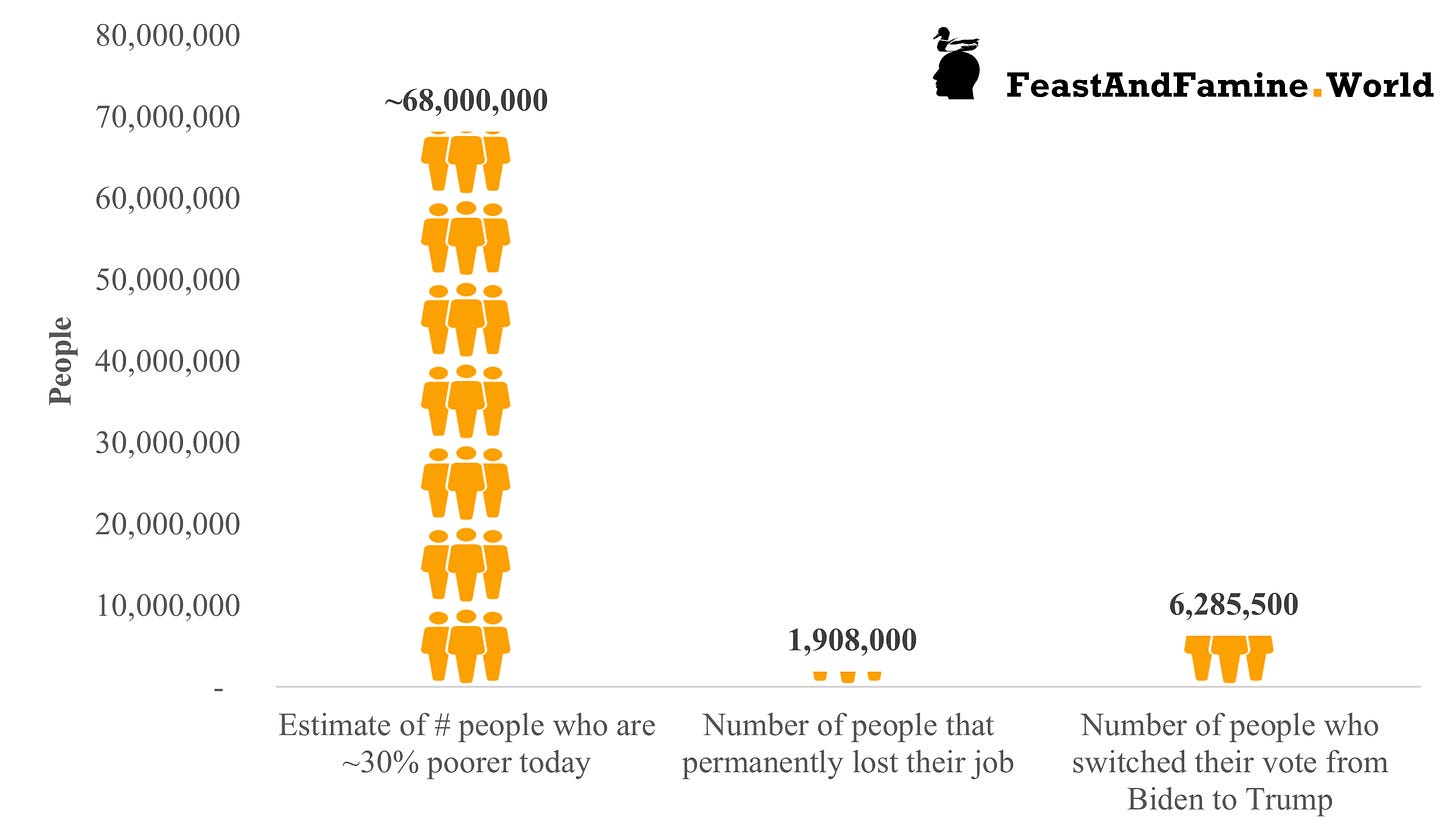

But how about those who lost their jobs due to the Covid and never manage to get back to the employment? There are about 1.9 million people like that who have lost ALL their earnings.

And here is the last question that is more rhetorical: how many people switched their vote from Biden to Trump in 2024 and why? Is it just in their heads or are we collectively using a gauge of economic performance that is not only useless but outright toxic?

-WH